Are you looking for the best discount broker in India to start your trade? Here we are going to review one of the best Indian discount brokers, 5Paisa. In this 5Paisa Review, we will cover all the important points like 5Paisa account opening, 5Paisa Trading, 5Paisa Demat Account Charges, 5Paisa brokerage & all.

Contents

What is 5Paisa?

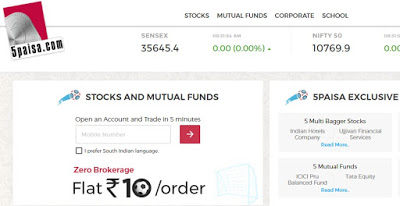

5paisa is a leading discount brokerage firm located in Mumbai. Unlike traditional brokers, discount brokers offer different brokerage services at very less charges. 5 paisa is a part of IIFL and it was re-launched in the year 2016 as a discount brokerage firm. IIFL was established in the year 1995 and has 1000+ branches in all over India.

How to open an account with 5Paisa?

5Paisa Account opening process

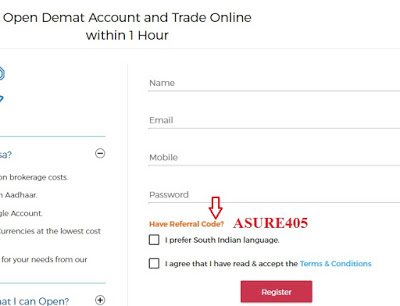

1. CLICK here to open the registration page. Enter this Referral Code: ASURE405 (You will get the registration amount refunded with the help of this code).

Also, it is not compulsory that you have to open a demat account with them. If you want you can make use of your already existing demat account by linking it with them. To open a demat account with them no charges are to be paid. Annual maintenance charges are charged by them on demand account, no account opening charges.

5Paisa Review: Brokerage & Charges

All about brokerage charges and fees of 5 paisa for the year.

5paisa brokerage plans

Segment | Brokerage charges |

Equity Delivery | Rs 10/executed order |

Equity Intraday | Rs 10/executed order |

Equity Futures | Rs 10/executed order |

Equity Options | Rs 10/executed order |

Currency Futures | Rs 10/executed order |

Currency Options | Rs 10/executed order |

Commodity | NA |

5 paisa account opening charges

Opening charges with trading account | Rs 650(one time only) |

Opening charges with demat account | Rs 0 (one time only) |

Annual maintenance charges with trading account | Rs 0 |

Annual maintenance charges with demat account | Rs 400 (per year) |

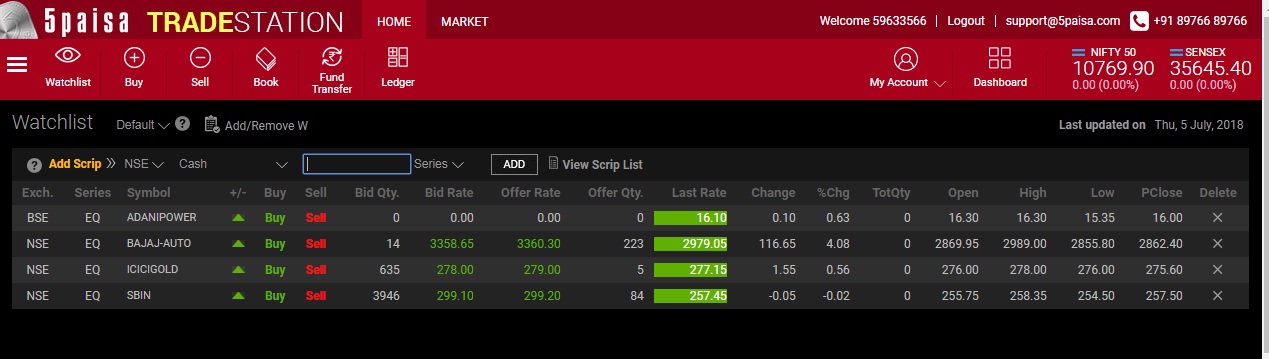

5Paisa Trading Platforms

5 paisa offers with the most innovative trading platform. One can get access to its trading platform via mobile, web browser and desktop. Here are the highlights of all its trading platforms

1) 5Paisa Web browser based trading

- To trade in most efficient manner and earn maximum profit it is must you should be able to trade when market presents with good opportunities. In the stock, market timing plays a vital role and if trading is not done at the right time it is really difficult to earn good returns.

- With web browser trading one can trade using a web bower by sitting at any place.

- You need to access the trading website using any of the devices like laptop, mobile phones, tablets etc. On that website, you can find all different trading and investment options.

- You need to log in using your login credentials. Once you are successfully logged in you can start trading.

- All advanced trading tools, live market updates related to stocks quotes and technical analysis is available to help traders take best possible decision while trading.

- To facilitate successful trading, their web browser based trading platform offers with all facilities required for instant fund transfer.

2) 5Paisa Desktop trading

- This trading platform is a convenient form of trading platform.

- 5 paisa has designed a trading terminal for its customers which can be installed on their computer system.

- With a desktop trading platform to provide flexible trading, there are several shortcuts available using which one can easily switch from one window to another and track market in real-time.

- This trading platform is best suited to those looking for some advanced features while trading.

- With this trading platform, one can get information related to all historic charts.

- With futures options and cash, multiple watch lists is available.

3) 5Paisa Mobile trading

- This trading platform is designed to meet the needs of traders who want to trade conveniently using their mobile phones.

- You need to download mobile app of 5 paisa to trade on your mobile phone.

- After successfully installing the app in your device you need to enter your login credential to prove yourself an authentic user.

- Once you log in, you can start trading across any segment like stocks, futures, options, currency, ETFs, mutual funds.

- They offer all live updates related to market quotes which are provided by NSE and BSE on their trading platform.

- To facilitate traders in taking a wise decision while trading all advanced charts and quality technical analysis is provided.

For trading with their any of the above trading platforms, no charges are to be paid. You can trade using any of their trading platforms as per your convenience for free of cost.

5Paisa Trading PROS

- In a cost-efficient manner, by charging a flat fee per executed order it offers with all the reliable services which are offered by a traditional brokerage firm.

- Flexibility to trade across different segments like currency, equity, options, futures.

- Using single mobile app you can trade in stocks, MFs, insurance all.

- Offers with all smart features like fundamental reports, technical advice etc to meet distinguish needs of individual traders.

- Brokerage plan is very affordable. Only Rs 10 per executed order, irrespective of trade size and segment.

5Paisa Trading CONS

- They have limited branches.

- You cannot open 3 in 1 account with them.

- They allow trading in all different segments but not commodities.

- There are no trading plans for monthly and yearly basis. You need to pay for every executed order.

- With them, you need to pay demat debit transaction charge of 0.04% which is quite high.

5Paisa Conclusion

5paisa offers to trade with most innovative trading platforms and trading tools using which one can have improvised experience of trading. With them using a single account you can trade in stocks and MFs both. Also, it is not mandatory to open an account with them; you can link our already existing account and start trading with them. They offer brokerage services at most competitive price i.e. Rs 10/executed order.