Are you confused in choosing the best from m Stock vs Zerodha? About m Stock vs Zerodha Charges. Which one is better? Here is a detailed comparison of Zerodha vs mStock stock brokers. After going through this blog post, you will learn which is good for you according to your trading needs.

Contents

m Stock vs Zerodha: Which is Better?

Let’s check this detailed comparison chart between mStock and Zerodha.

| Parameter | mStock | Zerodha |

|---|---|---|

| Trade In | Equity, Currency, Futures and Options, Mutual Funds, IPOs & ETFs | Equity, Commodity, Currency, Futures and Options, Mutual Funds, IPOs & ETFs |

| Account Opening Charges | Rs. 999 (One time fee with lifetime free brokerage plan) or Free with Brokerage Plan 2 | Rs 200 + Rs 100 for Commodity (optional) |

| Demat AMC Fees | Lifetime Free Amc by paying Rs. 999 or Rs. 120 per quarter | Rs. 300 (Rs. 75 per quarter) |

| Brokerage Plan | Life Time Zero Brokerage Plan or Brokerage Plan 2 | Single plan |

| Equity Delivery | Rs 0 (free) | 0 (Free) |

| Equity Intraday | Rs 0 (free) | 0.03% or Rs. 20 per executed order whichever is lower |

| Equity Futures | Rs 0 (free) | 0.03% or Rs. 20 per executed order whichever is lower |

| Equity Options | Rs 0 (free) | Rs. 20 per executed order |

| Currency Futures | Rs 0 (free) | 0.03% or Rs. 20 per executed order whichever is lower |

| Currency Options | Rs 0 (free) | Rs. 20 per executed order |

| Commodity Futures | Not Available | 0.03% or Rs. 20 per executed order whichever is lower |

| Commodity Options | Not Available | Rs. 20 per executed order |

| Call and Trade Charges | Free | Rs. 50 per order |

| Mutual Fund and IPO Investment Charges | Free | Free |

| Auto-square Off Charges | Rs. 20 per order | Rs. 50 per order |

| Pledge Creation/Confirmation/Invocation Charges | Rs. 15 per scrip | Rs. 20 per scrip |

| Margin Shortfall Penalty | 0.05% per day | 0.05% per day |

| Physical CMR Copy Charges | Rs. 100 | Rs. 100 |

| Off Market Share Transfer Charges | Rs. 25 per scrip | Rs. 25 per scrip |

| Funds Transfer Charges | Free | Free |

| Charges for Canceled Orders | Free | Free |

| GTT Order Charges | Not Available | Free |

| BTST Trading Charges | Free | Free |

| SEBI Charges | Rs. 5 per crore | Rs. 5 per crore |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| Stamp Duty | Varies as per state | Varies as per state |

| STT Charges | 0.1% on both buy and sell | 0.1% on both buy and sell |

| Transaction Charges | NSE: 0.00325% BSE: 0.003% | NSE: 0.00325% BSE: 0.003% |

| DP (Depository Participant) Charges | Rs. 13 per scrip | Rs. 13.5 per scrip |

m Stock’s Two Brokerage Plans

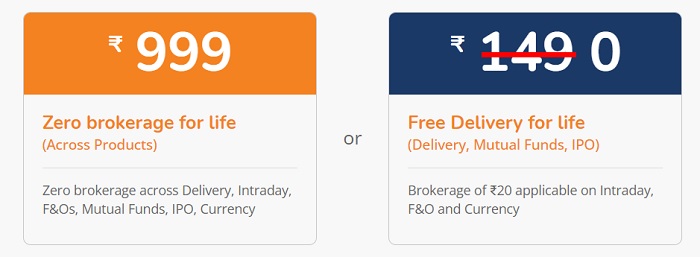

The difference between Brokerage Plan 1 and Brokerage Plan 2 offered by mStock is as follows:

- Brokerage Plan 1 is a one-time fee of Rs. 999, giving you lifetime free brokerage across all segments, including Delivery, Intraday, F&O, Currency, Mutual Funds, and IPOs.

- Brokerage Plan 2 is a free account opening plan that gives you free brokerage for Delivery, Mutual Funds, and IPOs. However, you have to pay Rs. 20 per order for Intraday, F&O, and Currency trading. You also have to pay Rs. 120 per quarter as AMC.

You can choose the plan that suits your trading needs and preferences.

You may like to read,

List of Failed Brokerage Firms- Why 10 Firms Failed?

m Stock vs Zerodha: Better Customer Service

A comparative analysis of mStock and Zerodha, based on web search results, reveals mixed feedback regarding their customer service. While some negative comments exist, both brokers also offer positive features worth noting.

mStock

- The introduction of MIRA, a virtual assistant, is a notable positive feature. MIRA assists clients in the account opening process and helps them navigate the app seamlessly.

- mStock acknowledges the diverse preferences of its clients by providing free call and trade services, catering to those who may not be comfortable with online trading.

- An escalation matrix is in place to address customer complaints effectively, showcasing the broker’s commitment to resolving issues promptly.

- In case of dissatisfaction with the resolution, customers have the option to complain to regulatory bodies such as SEBI or the exchanges.

Zerodha

- The email support provided by Zerodha is commendable, responding to queries within 1-2 business days, ensuring timely assistance.

- Zerodha’s comprehensive help center covers a wide array of topics and frequently asked questions, serving as a valuable resource for clients seeking information.

- The Trading Q&A forum is a unique feature where customers can interact, ask questions, and receive insights from both fellow traders and experts.

Considerations for Decision-Making

- Both brokers have their strengths and weaknesses in customer service, necessitating a comprehensive evaluation.

- Clients must weigh other critical factors, including fees, trading platforms, research capabilities, and available products, to make an informed decision.

- Individual preferences and specific trading needs play a pivotal role in determining the most suitable broker for an investor.

While both mStock and Zerodha have received feedback on their customer service, understanding the nuances of each broker’s offerings and comparing them against personal requirements is essential for making an informed choice in the dynamic world of online trading.

m Stock vs Zerodha: Trading platforms by both Brokers

mStock and Zerodha, both prominent players in the online trading space, offer versatile trading platforms to fulfil the diverse needs of investors.

mStock

- Web Portal and Mobile App:

- mStock’s web portal stands out for its simplicity, speed, and user-friendly interface. It seamlessly facilitates order placement, chart analysis, portfolio tracking, and access to various reports.

- The mobile app mirrors the efficiency of the web portal, ensuring a smooth and convenient trading experience. Notably, the app extends its functionality to allow users to invest in mutual funds and participate in Initial Public Offerings (IPOs).

Zerodha

- Kite Platform Ecosystem:

- Zerodha offers a comprehensive platform ecosystem, featuring the Kite web platform, Kite Connect desktop platform, and the Kite Mobile app. Each platform is designed to cater to specific trading preferences.

- Kite Web Platform:

- Kite, the web platform, stands out for its sleek design and lightweight structure. It integrates advanced features, including charting tools, indicators, market depth analysis, and various order types, empowering traders with in-depth market insights.

- Kite Connect Desktop Platform:

- Kite Connect, a desktop platform, operates on an API-based system. This unique feature enables users to build customized trading applications and seamlessly integrate them with third-party tools, providing a tailored trading experience.

- Kite Mobile App:

- The Kite Mobile app is a powerful and intuitive tool that facilitates on-the-go trading. Users can execute trades, access reports, and leverage analytics, all from the convenience of their mobile devices.

Platform Comparison

- Free Trading Platforms

- Both mStock and Zerodha offer free trading platforms to their customers, making trading accessible to a broad user base.

- Zerodha’s Edge

- Zerodha gains a competitive edge in terms of platform variety, functionality, and customization options. The Kite ecosystem, with its advanced features, provides a robust foundation for traders seeking a sophisticated trading experience.

- Additional Offerings by Zerodha

- Zerodha goes beyond the basics by offering partner products such as Coin, Console, Sentinel, and Varsity. These supplementary tools enhance the overall trading experience, providing additional features and services to Zerodha’s clients.

Both mStock and Zerodha present commendable trading platforms. However, Zerodha’s diverse and advanced platform ecosystem, coupled with its supplementary offerings, positions it as a compelling choice for traders seeking a comprehensive and customizable trading experience.

Comparison Chart of Features

| Features | mStock | Zerodha |

|---|---|---|

| Web Platform | Yes | Yes |

| Mobile App | Yes | Yes |

| Desktop Platform | No | Yes |

| API Platform | No | Yes |

| 1-Click Order Placement | Yes | Yes |

| Option Chain Analysis | Yes | Yes |

| Advanced Charts and Indicators | Yes | Yes |

| Advanced Order Options | Yes | Yes |

| One View Portfolio | Yes | Yes |

| Price Alerts | Yes | Yes |

| ZERO Pricing | Yes | No |

| Live Market Data | Yes | Yes |

| Voice Assistant | Yes | No |

| GTT Orders | No | Yes |

| True P&L | No | Yes |

| Baskets | No | Yes |

| Alerts | No | Yes |

| Nudge | No | Yes |

| IPOs using UPI | No | Yes |

| Partner Products | No | Yes |

FAQs to m Stock vs Zerodha

Q: What are the brokerage charges for equity intraday trading with mStock and Zerodha?

mStock offers zero brokerage for equity intraday trading under its lifetime zero brokerage plan. Zerodha charges 0.03% or Rs. 20 per executed order, whichever is lower.

Q: Which broker offers superior trading platforms and tools?

Zerodha leads with a variety of platforms – web (Kite), desktop (Kite Connect), mobile (Kite Mobile), and API (Kite Connect). Partner products like Coin, Console, Sentinel, and Varsity enhance user experience. mStock offers a user-friendly web portal, a mobile app, and a virtual assistant, MIRA.

Q: How can I open an account with mStock or Zerodha?

Open an account online by filling a form and submitting PAN card, Aadhaar card, bank details, and optionally, income proof. E-KYC ensures quick verification, allowing you to start trading within hours.

Q: Which broker provides superior customer service and support?

mStock offers free call and trade, an escalation matrix for complaints, and the option to complain to SEBI or exchanges. Zerodha excels in email support (1-2 business days), a comprehensive help center, and a Trading Q&A forum.

Q: Which broker offers better margin and leverage facilities?

Both offer margin and leverage. mStock provides up to 20x leverage for intraday, Zerodha matches this. Zerodha’s Margin Trading Facility (MTF) offers up to 4x leverage for overnight, with a 0.05% daily interest rate. mStock charges a 0.03% daily interest rate.

Conclusion

The comparison between mStock and Zerodha reveals distinctive strengths and features for traders to consider. mStock stands out with its zero brokerage for equity intraday trading and user-friendly platforms, including a virtual assistant, MIRA.

On the other hand, Zerodha demonstrates a competitive edge with a diverse range of advanced trading platforms, tools, and partner products like Coin, Console, Sentinel, and Varsity.

Whether it’s the seamless account opening process, customer service options, or margin and leverage facilities, each broker presents unique offerings. The choice between mStock and Zerodha ultimately hinges on individual preferences, trading requirements, and the emphasis placed on specific features like zero brokerage, platform variety, or additional tools.