In the ever-evolving landscape of stock trading apps, mStock has emerged as a noteworthy player, backed by the financial powerhouse Mirae Asset. This zero brokerage app boasts a user-friendly interface, real-time updates, customizable alerts, and a suite of analytical tools for seamless trading. However, like any platform, it comes with its set of strengths and limitations. Let’s delve into a detailed mStock app review, examining its features, benefits, and drawbacks.

Contents

mStock App Review: Introduction

mStock is a zero brokerage stock trading app launched by Mirae Asset, a global financial powerhouse. It offers a user-friendly interface, real-time updates, customizable alerts, and a diverse range of analytical tools for seamless trading.

Usually, brokers charge a flat fee or a percentage of the trade value, which can reduce your profits. mStock app does not charge any brokerage fees for any type of trade, which can save you a lot of money.

mStock app is created by Mirae Asset, which is a global financial company that manages money for people and businesses. Mirae Asset was started by Hyeon-Joo Park in 1997 in South Korea, and now it has offices in many countries around the world.

Mirae Asset also offers mutual funds, which are a type of investment that pools money from many investors and invests it in different assets.

mStock app offers mutual funds from Mirae Asset under the direct plan, which means there is no commission or expense ratio involved. Commission and expense ratio are the charges that mutual fund companies take for managing your money.

By choosing the direct plan, you can get higher returns from your mutual fund investments.

How to Download mStock App?

If you’re looking to kickstart your stock trading journey and leverage the features of the mStock app, here’s a comprehensive guide on how to download, install, and set up your account:

Step 1: Navigate to Google Play Store

- Launch the Google Play Store on your Android device.

Step 2: Search for mStock: Open Demat Account

- In the search bar, type “mStock: Open Demat Account” and hit Enter.

Step 3: Install the App

- Once you locate the mStock app, tap on the “Install” button. Allow the app to download; the time required may vary based on your internet connection.

Step 4: Open the App

- After the download is complete, tap on the “Open” button to launch the mStock app.

Step 5: Accept Terms and Conditions

- Upon opening the app, you’ll be prompted to review and accept the terms and conditions. Take the time to go through them and tap on the “Accept” button.

Step 6: Verify Your Mobile Number

- Enter your mobile number in the designated field. You will receive an OTP (One-Time Password) on your registered mobile number. Input the OTP to verify your mobile number.

Step 7: Provide Personal Details

- Fill in your personal details as required by the app. This typically includes your name, address, date of birth, and other relevant information.

Step 8: Upload Necessary Documents

- The mStock app may require you to upload certain documents to complete the account opening process. These documents may include proof of identity, address, and other KYC (Know Your Customer) documents.

Step 9: Pay Account Opening Charges

- To activate your Demat account, you will need to pay the account opening charges, which amount to ₹ 999. Ensure a secure and reliable payment method is used for this transaction.

Step 10: Explore Additional Plans

- The mStock app may offer a lifetime free AMC (Annual Maintenance Charges) plan for an additional ₹ 999. Consider opting for this plan if it aligns with your preferences and trading frequency.

M Stock App Review: Features

1. Zero Brokerage Across All Trades:

- Unlike most other brokers, mStock charges no brokerage for delivery, intraday, and F&O trades. This feature can translate to significant savings for frequent traders and investors.

2. Zero Call and Trade Charges:

- mStock allows users to place orders via phone calls without incurring additional charges. This is a valuable feature for individuals not comfortable with online trading or those facing technical issues.

3. Zero Annual Platform Charges:

- Users benefit from zero annual maintenance charges for utilizing the mStock app or web platform, setting it apart from brokers imposing recurring fees for their services.

4. Direct Plan Mutual Funds:

- mStock offers mutual funds from Mirae Asset under the direct plan, eliminating commissions and expense ratios. This can potentially enhance returns over time for mutual fund investments.

5. Margin Trading Facility:

- Offering up to 80% delivery funding at a low interest rate of 7.99%, mStock allows users to leverage their capital and choose from a pool of over 700 stocks for trading or investment.

6. Advanced Charting and Analysis:

- mStock provides users with a robust set of charting options, indicators, drawing tools, and technical analysis features. Customization options empower users to tailor charts and alerts according to their preferences and strategies.

7. Secure and Fast Transactions:

- Prioritizing user security, mStock employs encryption, OTP, and biometric authentication for verification. It facilitates fast and secure transactions through UPI, net banking, and IMPS.

mStock App Pricing

| Account Commencement/Opening Fees | ₹ 999 |

| Account Maintenance/Upkeep Charges | Free |

| Brokerage (Equity Delivery, Intraday, Futures & Options, Forex, Investment Funds, Initial Public Offering) | Zero |

| Call and Trade Fees | Zero |

| Dematerialization Charges (Sales Transactions) | ₹ 12 + GST per ISIN per transaction per day |

| Pledge Initiation and Conclusion Fees | ₹ 25 per PSN per day (+GST) |

| Interest Rate for Leverage Trading Facility | 6.99% – 9.99% |

You may like read,

5Paisa Review ; 5Paisa Trading & Demat Account Charges, Brokerage

List of Failed Brokerage Firms- Why 10 Firms Failed?

Explanation of Terms used in mStock App Pricing Table:

Account Opening Charges:

These are fees associated with opening a new account, often applicable in financial institutions, trading platforms, or subscription-based services.

Account Maintenance Charges:

This refers to fees for the ongoing maintenance of an account. In financial services, it could include charges to cover the cost of providing and managing the account.

Brokerage Charges:

In the context of stock trading, brokerage charges are fees levied by a broker for facilitating the buying or selling of financial instruments such as stocks, bonds, or mutual funds.

Call and Trade Charges:

Some trading platforms charge fees for executing trades over the phone. This service is known as “call and trade.”

DP (Depository Participant) Charges:

These charges are associated with the dematerialization of physical securities into electronic form. DP charges are often incurred during the sale of securities.

Pledge Creation and Closure Charges:

These charges are related to creating or closing a pledge, which involves using securities as collateral for loans or other financial transactions.

Margin Trading Facility Interest Rate:

For margin trading, where investors borrow funds to invest, an interest rate is charged on the borrowed amount. This rate can vary and is applied to the margin amount utilized.

mStock App Brokerage Charges

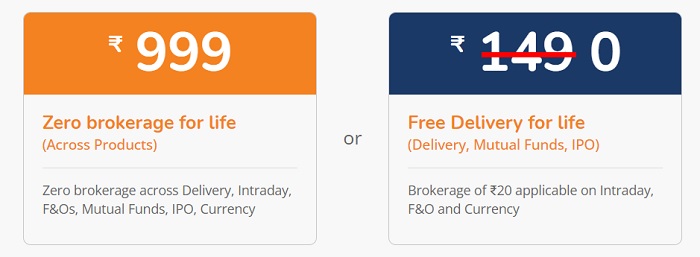

mStock App offers three types of plans.

- Free Delivery for life (A/c Opening Fees 149)

(Delivery, Mutual Funds, IPO)

Brokerage of ₹20 applicable on Intraday, F&O and Currency - Zero brokerage for life (A/c opening Fees 999)

Zero Brokerage Across All Segments - ₹999 FREE AMC

Free AMC for lifetime or pay ₹120 every quarter as AMC.

This chart will give you more clarification;

| Segment | Brokerage | Other Charges |

|---|---|---|

| Equity Delivery | Zero | DP charges, transaction charges, GST, SEBI charges, stamp charges |

| Equity Intraday | Zero | Transaction charges, GST, SEBI charges, stamp charges |

| Futures | Zero | Transaction charges, GST, SEBI charges, stamp charges |

| Options | Zero | Transaction charges, GST, SEBI charges, stamp charges, STT/CTT on intrinsic value |

| Currency | Zero | Transaction charges, GST, SEBI charges, stamp charges |

| Mutual Funds | Zero | None |

| IPOs | Zero | None |

mStock App Pros

1. Cost Savings:

- mStock can significantly reduce costs related to brokerage, call and trade charges, and platform fees, ultimately improving the net returns for users.

2. Diverse Investment Options:

- With zero brokerage and direct plan benefits, mStock opens doors to a diverse range of investment options, including equity, currency, futures, options, and mutual funds.

3. Margin Trading Opportunities:

- The app empowers users to trade with margin, allowing them to leverage their capital for increased profits and enhanced market opportunities.

4. Advanced Analysis Tools:

- mStock equips users with advanced charting and analytical tools, aiding in the analysis of market movements and trends. This enhances users’ trading skills and decision-making processes.

5. Secure and Convenient Trading:

- The user-friendly interface, real-time updates, customizable alerts, and secure transactions contribute to a seamless and convenient trading experience on mStock.

Cons to Consider

1. Lack of Trading Advice:

- mStock does not provide any trading advice, recommendations, research reports, or tips on stocks. This could pose a challenge for beginners or those seeking guidance and support.

2. Absence of Commodities Investment:

- The app does not offer the option to invest in commodities, potentially limiting diversification and risk management for users’ portfolios.

3. Occasional Glitches:

- Some users have reported occasional glitches, bugs, or errors, impacting the overall user experience. Issues such as login problems, order rejection, slow loading, and inaccurate data have been noted by a subset of users.

Is mStock App safe to use?

mStock app is a secure and stable platform that offers zero brokerage trading across various segments.

It is backed by Mirae Asset, a global financial services company with over 25 years of experience. It also claims to provide 100% data security by storing the data in the user’s mobile local storage.

However, as with any online trading app, there are always some risks involved, such as market volatility, technical glitches, cyberattacks, etc. Therefore, you should always do your research and exercise caution before investing your money.

Conclusion

mStock stands out in the market with its zero brokerage model, diverse offerings, and advanced analytical tools. However, potential users should weigh these advantages against the noted drawbacks to make an informed decision based on their specific trading needs and preferences. As the landscape evolves, staying updated on user experiences and app updates is crucial for those considering mStock as their preferred trading platform.